Revenue Audits

It is a fundamental principle of the Self Assessment system for Income Tax, Corporation Tax and Capital Gains Tax that returns filed by compliant taxpayers are accepted as the basis for computing tax liabilities.

This same principle applies to the PAYE and VAT systems. Revenue promotes compliance with the tax system through vigorous pursuit of those who do not file returns and by auditing selected returns and taking appropriate action against tax evaders.

What Triggers An Audit ?

Almost all audits are carried out for a reason. Only a small percentage of cases (in the order of 5% at the time of writing) are selected at random. You should therefore assume that Revenue are turning their attention to you because:

- Certain details in the returns, accounts or computations submitted do not concur with Revenue “norms” and/or

- Revenue have obtained information from or via a third party which leads them to believe that a return is not correct.

This of course does not necessarily mean that any further tax is due, or that any matter was indeed incorrect. It can be an extremely traumatic experience and few people in business will admit to being prepared for a thorough investigation of their business or tax affairs.

This is why it is very important that you consult your tax adviser before responding to any notification received of an impending Revenue audit.

We at Michael F. Dolan & Co. can minimize the impact of a Revenue Audit by:

- Preparing a review for the Revenue Audit visit.

- Dealing with the Inspector on your behalf during the audit and negotiating on any issues in dispute.

- Representing your interests before the Appeal Commissioners, the Ombudsman or the Courts.

Business Start Up & Company Formations

We at Michael F. Dolan & Co. can guide you through... Read More

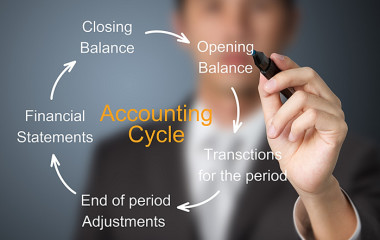

Accountancy

The bulk of our days at Michael F. Dolan & Co.... Read More

Payroll services

Let us take the responsibility for maintaining effective and efficient payroll... Read More